Our PLI is available upon request and is carried on us at all times ready for inspection by either the venue manager, guest, or event organizers.

If by any way our insurance is unsuitable for your event requirements, don’t hesitate to contact us to discuss your specific event requirements. Every event is different and for this, we are more than happy to work with you to make sure The Candy Floss King is able to attend your event. Contact us today to discuss your candy floss hire requirements.

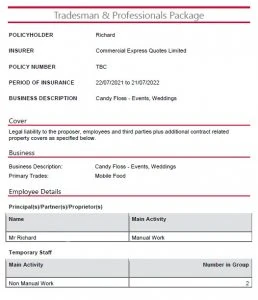

View our certificate and download it for your venue via our client portal. Even when a business does everything right there is always the chance of an accident happening. With the right insurance cover, a business can operate knowing that should the worst happen, their customers’ property could be repaired, their possessions replaced and their medical costs paid for. Many business owners don’t take the time to understand PLI and could face paying exorbitant fees for damages if their policy proves to be insufficient for their needs. PLI is the most common type of insurance taken out by small businesses, but with a range of cover options available, it’s just as well-suited to larger firms. Public liability insurance may be a confusing concept at first, but by researching precisely what liability insurance covers, you can find out just how much cover you should take out to safeguard your business in the public sphere. While public liability insurance is not a legal requirement for some businesses, it should be considered essential if members of the public will be interacting with your company in any way – from customers receiving deliveries to clients visiting your office or work premises. This means that even home-based businesses should consider public liability insurance if their home office is also used as a meeting place. Make sure the business you hire has public liability insurance Any business that has visitors to its premises or involves work on client sites needs public liability insurance. You should ask to see a company’s insurance schedule and documentation before taking them on. Employers’ Liability Insurance – If you employ staff you must take out Employers’ Liability Insurance by law. This cover is designed to protect the interests of employees in terms of illness or accident at work. Public Liability Insurance (PLI)

Public Liability Insurance.

Professional Indemnity Insurance – if you hire a professional, for example, an accountant or project manager, to work for you or your business you may wish to check that they hold adequate Professional Indemnity Insurance. This enables a company to meet the cost of claims against them for any of the following:

Any negligent act, error, or omission.

Implied Statutory Terms (e.g. Sale of Goods Act 1979).

Unintentional Infringement of Intellectual Property Rights.

Loss of Documents/Data entrusted to the insured.

Unintentional libel, slander, defamation.

Unintentional breach of confidence, confidential duty, or misuse of information. Find out how we can enhance your event.